Upon data migration to Business Central, customers often wonder why the monthly depreciation amount is different from their calculations. The only explanation we've identified so far is that the data provided for the migration inadvertently caused either over- or under-depreciation of depreciation amounts.

The

following example illustrates how BC's depreciation amount will differ from

your calculated amount.

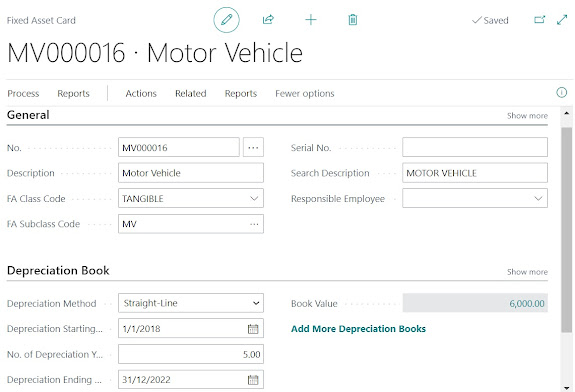

1.

The following asset was migrated to BC with the

cut-off date till 31st August 2022.

2.

You can print the Projected Value report to

check on the future depreciation and book value of the asset.

Page: Projected Value

3.

According to your book, the trend of monthly

depreciation from now until December 31, 2022 is $1,000, but BC is recording

$1,500 rather than your calculated amount. You can check the comparison below

between BC and your migrated data to see how BC came up with the amount.

Noticed that the migrated asset

is under-depreciated by $2,000 as of August 31, 2022, compared to the actual

calculation.

4.

To make sure the asset will be fully depreciated

as per Depreciation Ending Date, BC will use the Net Book Value at the point of

the time divide the remaining period to Depreciation Ending Date.

The table compares the actual depreciation with the recalculated depreciation for migration

Is

there anything BC-related that I can help you with? Or even simply want to say

Hi! Feel free to email me at "Hello365businesscentral" at Gmail; I

will do my best to assist you.

Comments

Post a Comment