Understand that some customer of the company might be the vendor of the company too. There is a feature in Business Central that allows users to consolidate both customer and vendor balances without making unnecessary payment or receipts.

Prerequisite

Setup for Customer and Vendor Consolidation

Page: Marketing

Setup

1. Setup a Business Relation Code for each Customers and Vendors.

2.

Assign a number series under Contact Nos. A

number will be pickup from the number series when there is a new Contact code created.

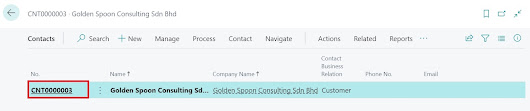

To Link the

Relation between Customer Card and Vendor Card

1.

Go to Customer Card, look for the customer

that you need to link in Customer Contact.

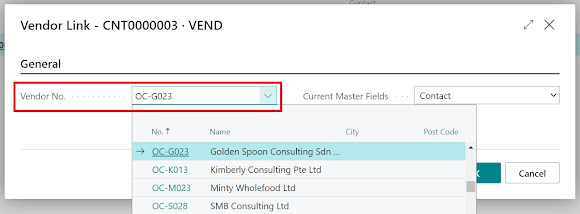

3.

Link with the Customer with existing Vendor.

(Path: Actions > Functions > Link with Existing > Vendor)

4.

Select the Vendor No. from the vendor listing

to link.

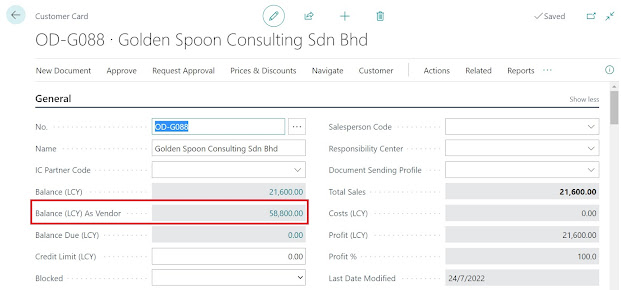

5.

The Contact Business Relation status should

have changed from Customer to Multiple.

6.

You can now see the balance from Vendor Ledger

in Customer Card.

7.

Same goes in Vendor Card, you will be able to see

the balance of the Customer Ledger.

Take note that you can also do it

another way around which is linking business relation from Vendor Card.

Customer

and Vendor Consolidation

Page: Payment Journal

1.

To consolidate the documents of same vendor

and customer, you will need to do it in Payment Journal page. Select “Net Customer/Vendor

Balances” from Prepare.

2.

Select Vendor No. that need to be

consolidated, then select OK to proceed.

3.

The offset entries will be automatically

created.

Comments

Post a Comment