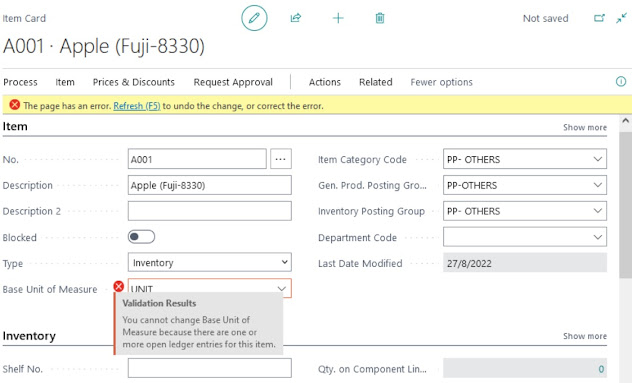

It is quite frequent that user need to change the existing based unit of measure of an item to another scale in order to fit the operation requirement. But do take note that once there is remaining quantity in the item, an error message will pop up to prevent user from changing the unit of measure in Item Cards.

Refer to the following scenario where the user need to change one of the item, from "Box" to "Pcs" with quantity still sitting in it. User will need to setup a UOM conversion where 1 "Box" of Apple is equivalent to 50 "Pcs" of Apple.

1. You will need to perform an negative adjustment on the item quantity. Generate the Inventory Valuation Report to confirm the total quantity that need to adjust out. This is to make sure that the adjustment will not impact the item valuation after the quantity adjustment, as it should remain the same value before and after the adjustment.

Report Path: Search > Items > More Options > Report > Inventory > Finance Reports > Inventory Valuation

2. Use "Negative Adjustment" in Item Journals to adjust ALL the quantity of Apple from the inventory. It is advise not to change the UNIT COST, user should follow as it is.

Page: Search > Item Journals

3. Once the Negative Adjustment is posted in Item Journals page, the balance quantity of the item should be Zero "0" now.

4. To setup the Unit of Measure conversion of the item, go to Units of Measure page.

Page: Search > Item > Select Item from the list > Select "Related" > Item > Unit of Measure

5. Select the "Base Unit of Measure" code that will be used by this item. Once the Base Unit of Measure is set up, you can set up alternate units of measure with a conversion factor using "Qty. per Unit of Measure".

NOTE that the base Unit of Measure should be the lowest denominator.

6. Proceed to Item Journals page to capture back the full quantity of the item using "Positive Adjustment". User will need to calculate the converted Quantity and Unit Cost based on the original recorded quantity and unit cost. The total "Amount" should be same as before the item change Unit of Measure.

7. After posting the "Positive Adjustment" in Item Journals, the item quantity will now be updated based on the new Base Unit of Measure.

Do you have question on BC that you think I can help?

Drop me an email at "Hello365businesscentral" at Gmail, I will try to answer if I can.

Comments

Post a Comment