A company is going to acquire a new car for $100,000.

However, the supplier agrees to give a discount of $5,000 if the company agree

to trade-in an old car with the new car. The cost of the old car is $ 120,000

and accumulated depreciation of $ 112,500.

It means the company sells an old car for $ 5,000 and buys a

new car that costs $ 100,000. They end up paying $ 95,000 only. The total loss

of disposal will be as follows: -

Loss from disposal = $ 5,000 – ($ 120,000 – $ 112,500)

= $ 2,500

|

Account |

Debit |

Credit |

|

New Vehicle |

100,000 |

|

|

Accumulated Depreciation – Old Vehicle |

112,500 |

|

|

Loss on disposal |

2,500 |

|

|

Fixed Assets – Cost of old Vehicle |

120,000 |

|

|

Cash |

95,000 |

Business Central able to capture the activities without hassle.

1.

To record the Disposal of asset with a

loss

Page: Sales Invoice

i.

You can select the customer that the fixed asset

is selling to and select the fixed assets that you are disposing.

ii.

The Amount will be the discount amount that the

supplier is offering for the asset trade-in.

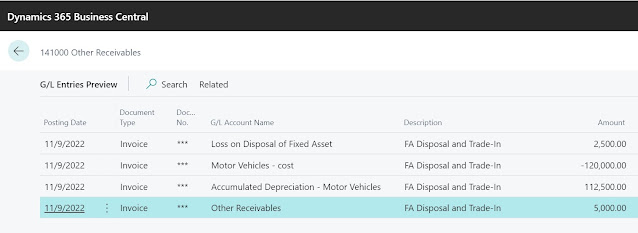

iii. Checking in Preview Posting, the accounting

entries will be as per screenshot below. The old asset cost and accumulated

depreciation is reversed, and loss of disposal is recorded.

iv. You may print the Sales Invoice/Tax Invoice from

this page as source documents.

v.

Post the sales invoice once details are recorded

according to the agreed terms.

2.

To capitalise the new asset to Fixed

Asset during the Trade-In

Page: Fixed Asset Card

i.

Create the new asset detail for the new asset in

Fixed Asset card

Page: Fixed Asset G/L Journals

i.

Record the Fixed Asset Cost with the original acquisition

cost.

ii.

In the next line after the acquisition cost,

enter the discount of the new asset for the trade-in of old asset. Note that

the Account Type here will be the “Customer”, the supplier that offering

discount for the old asset trade-in.

iii.

Following with the next line will be the balance

amount of the acquisition after the discount. The Account Type here will be the

“Vendor”, the supplier that you purchase the new asset from.

iv.

Check the accounting entries for this transaction

from Preview Posting.

v.

Proceed to post the entry in Fixed Asset G/L

Journals.

vi.

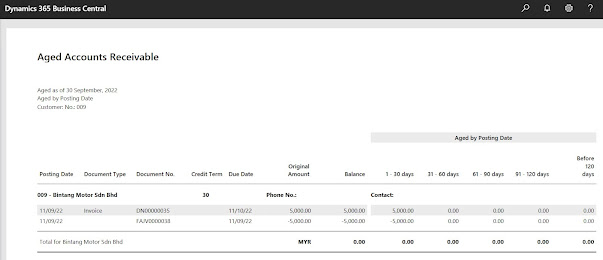

The balance in receivable in “AR Aging” should

be offset after the posting.

v

viii.

Do remember to change the old asset status to “Inactive”

in Fixed Asset Card.

Comments

Post a Comment