Most of the clients that we have come through have the same question asked on why they can’t just maintain 1 posting number series for transaction posting in especially in Journals related page such as General Journals, Payment Journals and Cash Receipt Journals.

The main reason for such design in BC is to prevent gaps in

the document number sequence especially in financial transaction. This feature

come in handy if auditors to check if there are any gaps in the document number

assigned to.

I

will use the following scenario to explain how it works.

A

journal batch was created with the following number series assigned in No.

Series and Posting No. Series. When the entries are being prepared but not

posted, system will assign the document number from “No. Series” – WJV22-00001.

The

following entries are prepared, and BC auto assigns the next document number

based on the No. Series setting in General Journal Batch.

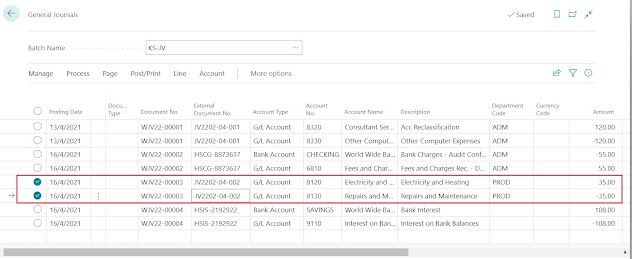

After

reviewing the entries, the entries with Document Number “WJV22-00003” need to

be removed as the entry no longer needed.

Now the batch is going to be posted with the missing gap in Document

Number.

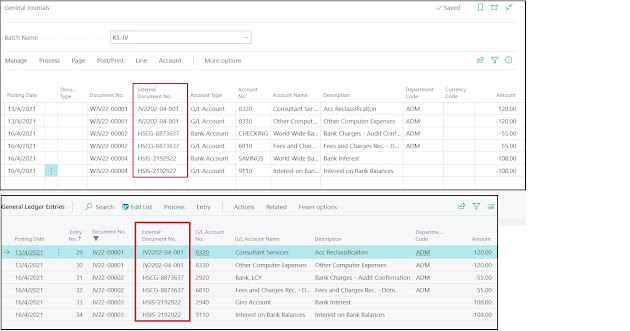

Checking

to the General Ledger Entries, the 3 entries that posted are assigned with another

set of new Number Series from “Posting No. Series” in General Journal Batches.

Noticed there is no gap in posted Document Number although there is gap earlier

before posting.

Question: Using 2 different Document Number series,

how should I know the document that I prepared and posted is still the same document?

Answer: User can enter a unique number in External Document

No. for tracing.

Question:

What if I still want to maintain 1 set of Number Posting Series instead of 2?

Answer:

It will only work if the environment only uses 1 single batch to capture

all journal transaction. If there is more than 1 batch being setup in the

environment and all are using the same Number Posting Series, the first document

number that assigning in each batch will be the same Document Number.

Refer

to the scenario below, with 3 new batch created and assigning with same Number

Series, all first document number will be assigned with same Document Number “JV22-00005”.

BC will not assign next new number until the Last No. Used

field is updated, and it can only be updated if there is successful posting

happened.

If

the user proceeds to post the entry, it will get the following error message: -

“You

have one or more documents that must be posted before you post documents no. XXX

according to your company’s No. Series setup.”

Comments

Post a Comment