Extending Your Financial Year in Dynamics 365 Business Central

Need to extend your current financial year in Microsoft Dynamics 365 Business Central (BC)? You can easily do this within the "Accounting Period" page. This post will guide you through extending your financial period, for example, from the standard 12 periods (1/1/2024 - 31/12/2024) to 15 periods (1/1/2024 - 31/03/2025).

Step 1: Ensure Your Financial Year is Open in Business Central

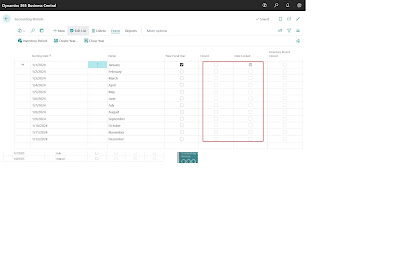

Before extending your accounting period in Dynamics 365 Business Central, the first crucial step is to verify that the financial year you want to extend is still open. Navigate to the "Accounting Period" page and check the “Closed” and “Date Locked” columns for the financial year ending 31/12/2024. These columns should be clear, indicating an 'Open' status.

Comments

Post a Comment